The Office of Financial Aid works diligently to lighten the weight of the Rollins College price tag, one that costs over $65,000. The office’s goals include providing Rollins-specific aid and educating students about their financial statuses.

“We know that giving financial aid to students can change lives,” Steve Booker, director of the Rollins College Office of Financial Aid, said. “As a result, an impressive 94 percent of the Class of 2022 received some sort of aid this year, including both Rollins-specific and federal aid.”

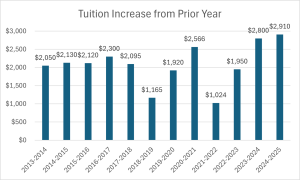

According to College Board, the nation’s average private college costs $34,740 per year, making Rollins’ fees appear extreme. When considering added room and board fees, residential students will pay $67,942 and commuters will pay $55,862.

“All scholarships are considered financial aid. The U.S. Department of Education considers any type of award to a student (including grants, scholarships, loans, and work) as financial aid,” Booker said.

Lower-income groups, who otherwise would not be able to attend Rollins, are given the opportunity to afford a private school education by way of financial aid. Rollins’ financial aid is a considerable reason why the Class of 2022 is one of the most diverse classes in college history.

“[The office] partners with the Harris Rosen foundation and the Boys and Girls club to give low-income students the aid they need,” Booker said.

He explained that, while Rollins always does its best to offer scholarships, “there was also a 2 percentage point increase in the amount of Pell Grant recipients this year.” Pell Grants are given to students identified with the highest financial need.

Despite the goals of the office, some students feel as if their financial situation has been overlooked. One freshmen, for instance, did not believe that their financial needs were fully met.

“I think Rollins met my need enough, but it could have been better,” Zoe Milburn (‘22) said. “There are four kids in my family attending college, meaning we have four separate tuitions to pay.” Milburn is not taking out any loans, but the remaining payments are coming out of her parents’ pockets.

The office also aims to encourage financial literacy, promoting the ability to manage personal finances among students.

“The state of Florida now requires Rollins to send out loan letters,” Booker said.

These loan letters promote financial literacy by keeping students updated on their loan status, making them aware of what they owe and how to plan to pay. “There is a nationwide need for financial education,” he said.

Students agreed that their generation’s financial literacy is not up to par.

“The amount of people who are financially literate is probably low,” Milburn said. “Students are not often taught financial responsibility or how to do a lot of real-life things.”

The office wishes to increase financial literacy on campus by continuing workshops and having more classroom discussions. It is motivated to appeal to students and make it more interesting to learn the fundamentals of finances.

Students are encouraged to apply for jobs both on and off campus through Handshake, a website where students and recruiters can share opportunities. The office also enthusiastically encourages students to make appointments with experts.

“We are happy to meet with students,” Booker said. “We’d love to do four-year plans for students who are concerned about their financial statuses.”

Be First to Comment