President Donald Trump’s Agenda 47 outlines plans to “impose tariffs on foreign producers through a system of universal baseline tariffs on most imported goods.” Under the plan, these tariffs would increase incrementally, if countries manipulate their currency or engage in unfair trading practices, with the stated goal of lowering taxes on American workers and businesses.

On the campaign trail, Trump stated plans to impose a 10 to 20 percent baseline tariff on most foreign goods. He also suggested leveraging a 60 percent tariff on imports from China. It is important to note that these percentages are based on campaign statements made by the President-elect and have not been listed as official policy.

Additionally, Agenda 47 aims to eliminate U.S. dependence on China and phase out Chinese imports of essential goods, which are described as “everything from electronics to steel to pharmaceuticals.”

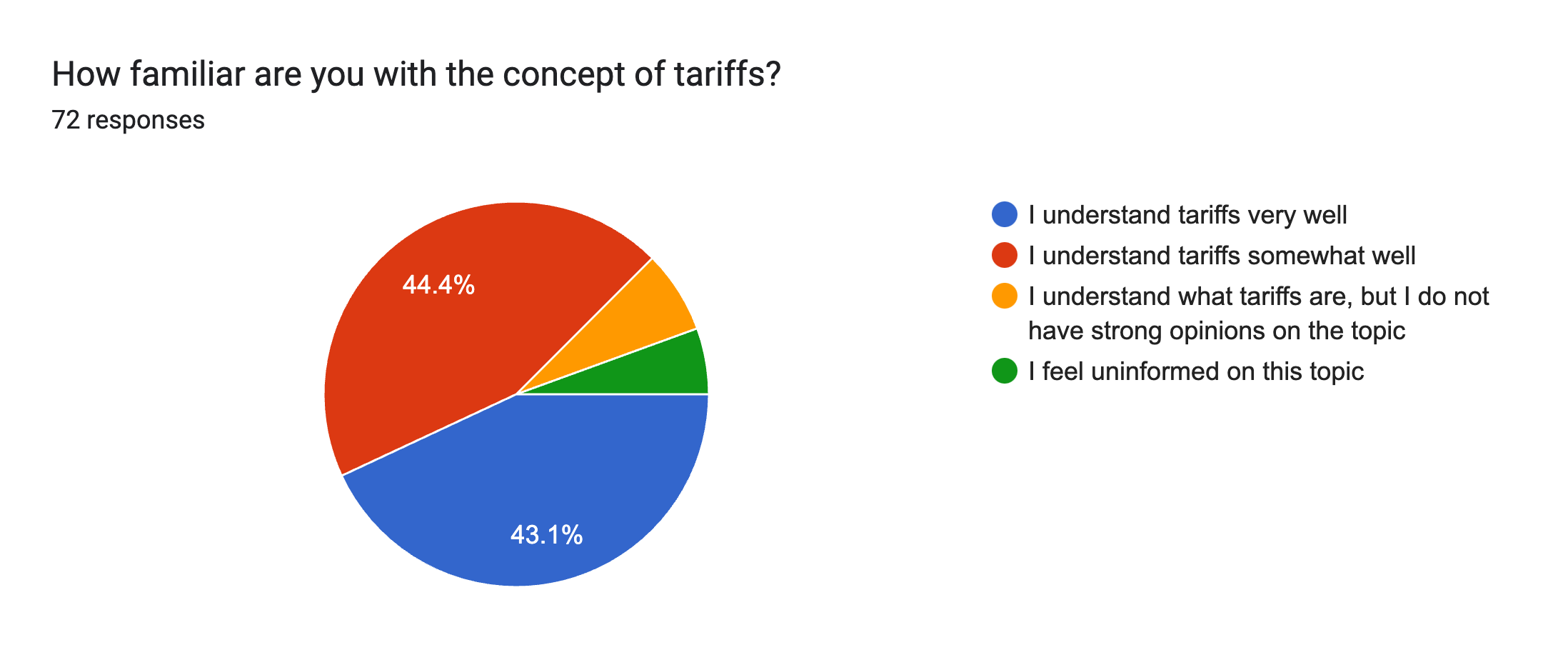

In the week following the 2024 presidential election, The Sandspur conducted an anonymous survey to gauge students’ understanding of tariffs and their general views on trade relations. A total of 72 students responded. In addition to their response, several students elaborated on their positions in the form’s comment section.

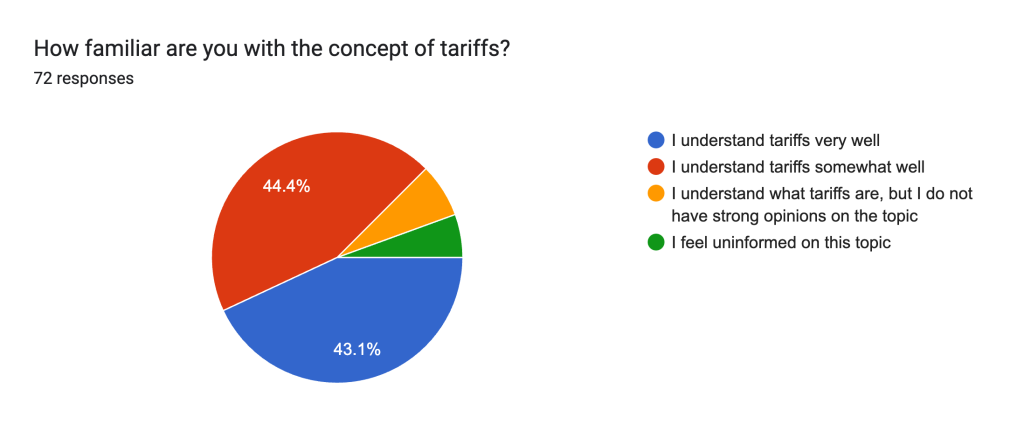

Nearly 88 percent of student respondents reported understanding tariffs either “very well” or “somewhat well.” Only around 5 percent of students reported being uninformed on the topic.

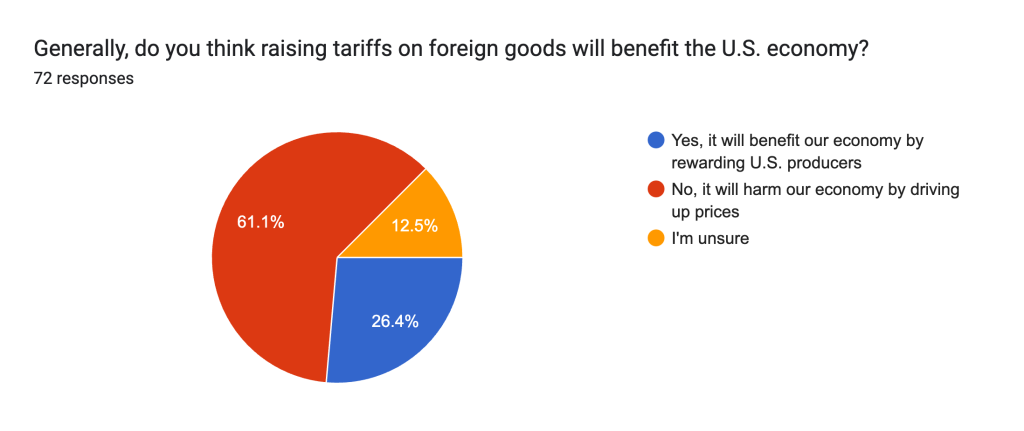

Over 60 percent of students reported that raising tariffs is likely to harm the U.S. economy by driving up prices, while over 25 percent indicated that raising tariffs would generally benefit domestic producers.

One respondent said, “Tariffs increase consumer prices, decrease domestic competition, decrease job opportunity for working-class Americans, and decrease the quantity of goods being produced.”

“Expecting increased tariffs to not end up impacting consumer prices expects corporations to act in the best interest of consumers, which they do not do,” said another.

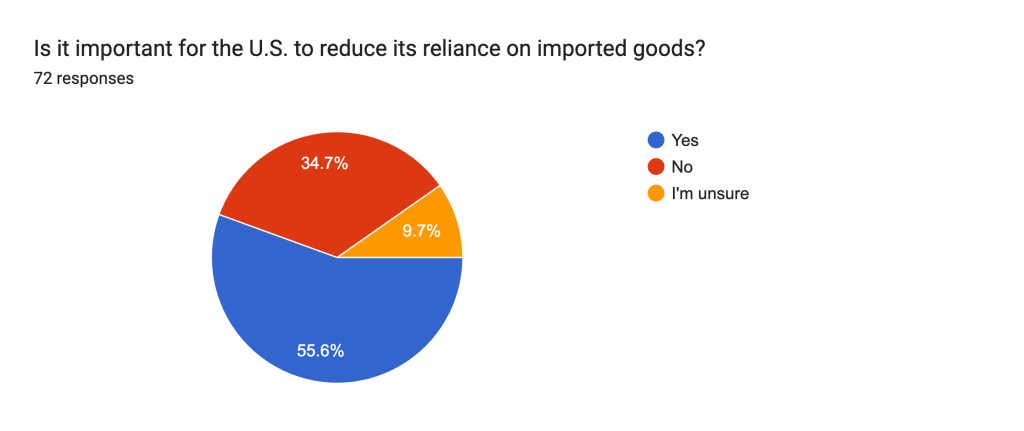

The majority of students surveyed agree that it is important for the U.S. to reduce its reliance on imported goods.

One respondent said, “I think it is important for the US to weaken its reliance on imported goods, but we do not currently have the infrastructural capacity to supply our own goods (through physical labor, factories, means of production, etc.).”

Another addressed the topic of energy independence and said, “I’m in support of reducing reliance on foreign fuel, but I don’t mind that we rely on imports for other raw materials to make our manufactured goods.”

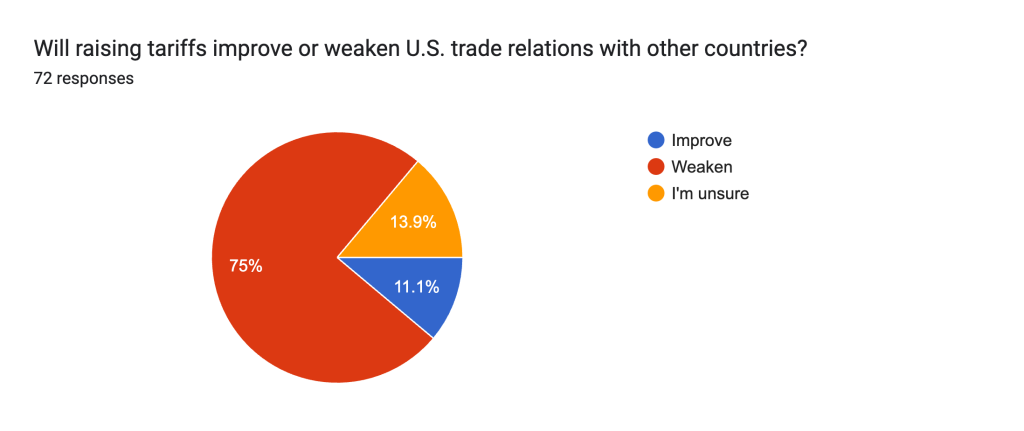

75 percent of students reported that raising tariffs would weaken U.S. trade relations with other countries. Just over 11 percent of students reported that raising tariffs would improve U.S. trade relations with other countries.

“The US should only implement tariffs on countries that it has a trade deficit with, and the tariff should reflect the size of the deficit, rather than the proposed blanket tariffs,” a student said.

Over 60 percent of students answered that cooperation with China is more beneficial for the U.S. economy, while over 20 percent indicated that an adversarial relationship is necessary to protect U.S. economic interests.

“While it is important to stimulate the American economy by directing production to USA-run companies, we unfortunately live in a global economy. China is the largest exporter in the world and any products that we buy, even if not directly from China, may somehow originate from China,” one respondent said.

Based on the survey data, most students are concerned about the economic impact of raising tariffs but support the U.S. being less reliant on imports.

Matthew Rice, professor of economics at Rollins, offered clarification on these concerns. “Tariffs are always passed on to the end consumer. We the consumers will be paying for these tariffs,” he said. “When you start talking about tariffs across the board, or even just tariffs targeting particular countries, it’s going to be very difficult to keep costs down.”

Professor Rice acknowledged that the U.S. should have a greater industrial base but suggested alternatives to tariffs. He said, “There can be direct investment; there can be subsidies overseen by the federal government; there can be tax policies that dissuade companies from moving jobs overseas in the first place.”

Comments are closed.